The Consumer Financial Protection Bureau (CFPB) finalized a rule in 2017 that prohibited financial contracts from containing forced arbitration clauses with class action bans. But members of Congress, pushed by bank lobbyists, repealed the rule using an obscure law called the Congressional Review Act.

The CFPB rule, issued after a comprehensive study, addressed the harms caused by forced arbitration in two central ways:

1. It restored the right of consumers to join together in court by prohibiting class action bans, giving consumers a way to hold corporations accountable for systemic misconduct including small-dollar claims too costly and onerous to bring one-by-one as individual claims;

2. It returned transparency to individual arbitration and allowed further study on the arbitration process and outcomes by requiring companies to submit information on customer claims, which would be posted publicly with identifying information removed.

The CFBP rule to restrict forced arbitration was met with widespread support. Below are selected highlights of comments from individual consumers, elected officials, advocacy groups and newspaper editorial boards who weighed in during the public comment period.

More Than 100,000 Consumers Across the Country

Support the Rule

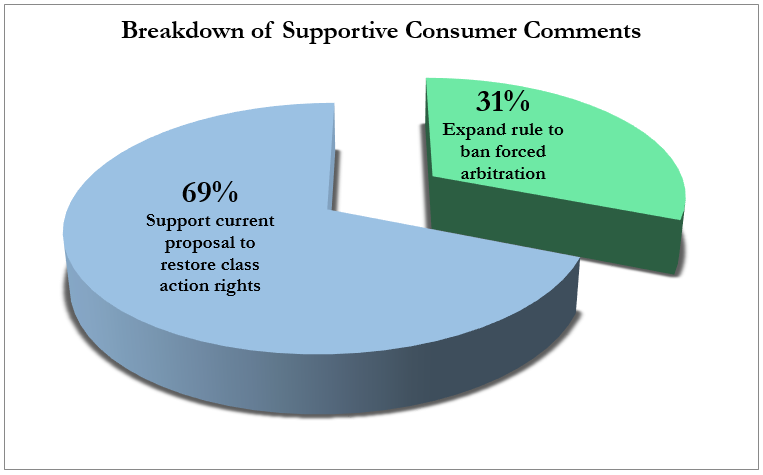

Between the proposed rule’s announcement and the close of the comment period, at least 100,000 individual consumers across the country submitted comments or signed petitions urging the CFPB to restrict forced arbitration in consumer finance. On the other side, FreedomWorks – a conservative political group affiliated with the Tea Party – claimed it “generated nearly 15,000 responses opposed to the rule.”

Of the 100,000-plus positive comments, 69 percent of consumers voiced general support for the proposed rule, emphasizing that “[b]arring consumers from joining class actions directly opposes the public interest.” Another 31 percent pushed the CFPB to expand the rule’s coverage and “take the extra step to prohibit individual arbitration in the final rule.”

This overwhelming support for action against forced arbitration echoed a national poll, which found that, by a margin of 3 to 1, voters in both parties support restoring consumers’ right to bring class action lawsuits against banks and lenders.

Key Statements of Support

The Military Coalition, representing 5.5 million servicemembers, applauds the rule

“Forced arbitration is an un-American system wherein service members’ claims against a corporation are funneled into a rigged, secretive system in which all the rules, including the choice of the arbitrator, are picked by the corporation.”

423 law professors and academics strongly oppose efforts to block the CFPB’s arbitration rule

“Based on our varied scholarship and teaching backgrounds, we all agree (1) it is important to protect financial consumers’ opportunity to participate in class proceedings; and (2) it is desirable for the CFPB to collect additional information regarding financial consumer arbitration.”

38 U.S. Senators commend CFPB for proposed rule

“Recognizing the urgent need to address these troubling practices, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 to improve accountability, strengthen the financial system and establish the CFPB. Dodd-Frank included several restrictions on the use of forced arbitration, including a mandate for the CFPB to take action on arbitration. Congress specifically directed the CFPB to study the use of forced arbitration in connection with the offering of consumer financial products and services, and authorized it to ‘prohibit or impose conditions or limitations on the use of’ such agreements based on the study results.”

65 members of the U.S. House of Representatives praise the rule

“Consistent with the bureau’s exhaustive study on forced arbitration, which found that forced arbitration restricts consumers’ access to relief in disputes with financial service providers by limiting class actions, the proposed rule is a critical step to protect the public interest by ensuring that consumers receive redress for systemic unlawful conduct… There is overwhelming evidence that class-action waivers in financial products and services agreements undermine the public interest.”

18 state attorneys general want to extend the reach of state enforcement efforts

“Although we believe consumers will be best served by the total prohibition of mandatory, pre-dispute clauses in consumer financial contracts and we encourage the Bureau to consider regulations to that effect, the proposed rules provide a substantial benefit to consumers by restoring their fundamental right to join together to be heard in court when common disputes arise in the commercial marketplace. Many of our respective consumer protection laws include private right of action provisions, the purpose of which is to complement and extend the reach of our state enforcement efforts.”

“Because of these resource limitations, states rely on the private cause of action to give effect to their consumer protection laws. Arbitration agreements that undermine the effectiveness of the private cause of action undermine the force and effectiveness of state consumer protection law too… States often serve as the ‘laboratories of democracy’ that allow for experimentation with consumer protection regulation. This experimentation is critical to the calibration of a regulatory scheme that allows for easy access to safe and affordable credit. When consumers cannot enforce state consumer protection laws, lawmakers like us cannot measure the efficacy of those laws and cannot observe the effects of those laws as they evolve through litigation. That stifles the healthy development of consumer protection laws nationwide.”

Notable Comment Letters

310 consumer, civil rights, labor and small business groups strongly support the rule

“The CFPB rule, which will restore consumers’ ability to band together in court to pursue claims, is a significant step forward in the ongoing fight to curb predatory practices in consumer financial products and services and to make these markets fairer and safer… Because forced arbitration undermines compliance with laws and creates an uneven playing field between corporations that use forced arbitration and those that allow for greater consumer choice in dispute resolution, it is in the public interest and in the interest of consumer protection to prohibit or strictly curtail the use of forced arbitration clauses in consumer financial contracts.”

“[F]orced arbitration clauses along with class action bans do not provide a net benefit to consumers. As many have already pointed out, businesses would not need to impose forced arbitration if consumers believed that it benefits them. Nevertheless, proponents argue that it lowers the cost of providing consumer products and services. This claim has not been supported with any credible economic data or studies. Even if such claims were true, there is no evidence to suggest that any such cost savings have been passed on to consumers.”

Americans for Financial Reform

“While an individual consumer may only lose less than $100 to an improper fee, unlawful practices implemented on a broad scale quickly amount to millions in unearned profit for banks and lenders who violate the law. Though industry representatives might prefer to shift the focus to attorneys’ fees, it is essential to note that – without class actions to return money to large numbers of consumers – banks and lenders that violate the law retain a full 100 percent of these ill-gotten funds. Thus, consumers’ ability to challenge such practices in private class actions can help deter fraudulent behavior that might otherwise prove very profitable. Because government enforcement agencies lack the resources to police every instance of financial fraud, consumer class actions serve as a necessary check to ensure a fair and competitive financial market.”

Consumers for Auto Reliability and Safety (CARS)

“Consumers deserve at least the same freedom, protection, and access to justice as car dealers, who were granted a special exemption from the Federal Arbitration Act by Congress… As Senator Grassley, speaking in support of S. 1140, stated: ‘When mandatory binding arbitration is forced upon a party, for example when it is placed in a boiler-plate agreement, it deprives the weaker party the opportunity to elect another forum. As a proponent of arbitration, I believe it is critical to ensure that the selection of arbitration is voluntary and fair.’ While S. 1140 did not pass, auto dealers were granted an exemption from the Federal Arbitration Act, to preserve their rights, through the passage of H.R. 2215 in 2002.”

The Leadership Conference on Civil and Human Rights

“Private class actions have been and continue to be critical to protecting civil rights in the financial sphere… Civil rights consumer class actions provide relief beyond the named plaintiff by remedying and deterring civil rights violations and systemic discrimination. Moreover, there is a public value in bringing discrimination into the light of day through consumer civil rights class actions… Individual private arbitration is a poor forum in which to vindicate civil rights claims, especially because victims of discriminatory lending often do not know they have been harmed. Individuals who suspect they have been discriminated against may not know the amount of damages they have suffered and may be discouraged from investing the time and resources to pursue individual claims in arbitration.”

“Class actions are an invaluable tool for small businesses contesting the use of monopoly power to increase prices… Center for Justice and Democracy compiled a list of major recent price-fixing lawsuits involving the cost of air-freight shipping, commercial insurance, auto parts, LCD screens, and random access memory chips. These cases have already delivered substantial relief, ranging from $5,000 to more than $2 million, to a wide array of small- and medium-sized business plaintiffs. Yet many arbitration clauses bar small businesses from joining their claims together in this way… On behalf of the thousands of small business owners we represent, we commend the CFPB’s proposed rule and encourage the Bureau to issue a strong final rule.”

“Class actions have proven to be essential in rooting out discriminatory practices that disproportionately harm African Americans and communities of color… between 2007 and 2009, during a period in which the federal government was relatively inactive in fair lending enforcement, a group of private counsel filed fair lending class actions against a number of major mortgage lenders, alleging discriminatory mortgage pricing in violation of the Equal Credit Opportunity Act and the Fair Housing Act… These actions led to industry-wide reforms, including caps on dealer mark-ups, as well as pre-approved financing for minority customers and consumer education.”

National Association of Consumer Advocates

“The widespread suppression of consumer finance claims not only denies remedies for millions of American consumers and encourages ongoing risky conduct, it also stunts the necessary development of consumer protection laws. Indeed, the bureau oversees compliance of, and enforces numerous and vibrant consumer protection laws, many of which afford a private right of action for consumers to pursue remedies of their own. Courts’ opportunities to weigh factual disputes and interpret these laws and incidentally create precedent to be followed in future cases are reduced significantly by forced arbitration.”

“If opponents of the arbitration rule have a problem with the availability of class actions or with the procedural rules governing the adjudication of class actions, their recourse is to Congress or the Rule 23 Subcommittee—they should not be permitted to create a contractual fiction that allows them to bypass class actions entirely. Pre-dispute arbitration agreements do not prevent frivolous class actions. They prevent all class actions no matter how meritorious. The agreements typically do not even allow an arbitrator to award class-wide relief.”

“The financial services industry and its representatives have openly acknowledged that the purpose of forced arbitration clauses is to limit their legal exposure and to suppress consumer claims. Such admissions are significant: They signal some providers’ resolve to flout consumer protection laws by blocking private enforcement actions… Industry’s claim that class actions benefit plaintiffs’ attorneys over consumers is a false talking point that should be laid to rest. According to the [CFPB] Study, between 2008 and 2012 consumers across the product markets studied received $2.2 billion in net relief—that is, over and above attorneys’ fees and litigation costs. In another empirical study, academic researchers found that class actions against illegal overdraft fees resulted in fair compensation to class members, in that the compensation was commensurate with the strength of the class claims and was delivered to a significant portion of class members.”

Major Editorial Endorsements

Let Consumers Sue Banks ׀ USA Today

“The private system, originally meant for business vs. business disputes, shields financial institutions from class action lawsuits that can unleash embarrassing publicity about deceptive or unfair practices, force them to stop such rip-offs, and require them to pay millions of dollars to injured customers.”

Forcing Banks to Fight Fair ׀ The New York Times

“In recent decades, banks and other corporations have increasingly required customers to agree in advance to individually arbitrate any conflicts that arise over products and services, rather than sue in court. Arbitration, however, has turned out to stack the deck; corporations choose the arbitrators and set the rules of evidence. As a result, individuals usually abandon the effort rather than pursue their grievances.”

If the Consumer Financial Protection Bureau is dying, at least it’s going out with a bang ׀ Los Angeles Times

“Nevertheless, the arbitration rule is a timely reminder of why we need a strong and independent CFPB tackling problems that other financial regulators have ignored. Arbitration is fine as an optional alternative to lawsuits, but banks and other financial services companies have been routinely requiring customers to submit any and all disputes to binding arbitration. They’ve then used those clauses to stop customers from joining forces in class actions, which makes it pointless for consumers to pursue claims when their losses are smaller than the cost of an arbitrator. In effect, that gives companies carte blanche to cheat and defraud on a wide scale, as long as they don’t take very much from any individual.”

Fighting to make sure the little guy gets crushed ׀ St. Louis Post-Dispatch

“If banks and other credit providers abuse customers as a group, those harmed should be able to fight back as a group. Had the CFPB not taken its action, banks and credit providers would be able to continue abusing and bullying consumers with impunity. Key House Republicans believe, however, that it’s the CFPB, not banks and credit companies, that needs restraining…Exactly whom they’re fighting for isn’t quite clear, but it’s sure not consumers victimized by financial corporate behemoths. All the companies want is their unfair advantage. It’s strange the lengths to which some in Congress will go to fight against the little guy.”

A Fair Shake for Consumers ׀ The San Francisco Chronicle

“Few customers read the fine print on credit card and bank agreements when it comes to settling disputes… The real purpose of the small-type agreements is to save banks and lenders from a challenge brought by pools of unhappy customers filing class action suits in the name of broad ranks of gouged consumers. If successful, such lawsuits can run into millions, instead of the paltry sums doled out by arbitration.”

Consumers Have a Right to Go to Court ׀ The Boston Globe

“The bureau’s planned change could save consumers money and aggravation by eliminating an unfair advantage companies hold over anyone who dares to challenge a late fee or early-termination penalty. The arbitration clauses are designed to prevent customers from taking legal recourse against a business. Specifically, they keep them from joining a class action lawsuit… Even the very notion of arbitration is enough to discourage most wronged consumers from taking on a bank or corporation over an unwarranted charge — it’s usually not worth the time and effort.”

Customers Finally Get Some Help Against Big Banks ׀ The Sacramento Bee

“It’s a necessary step to level the playing field, at least somewhat, for lowly customers against these financial behemoths, which have used the fine print of agreements to force consumers to take all disputes into binding arbitration instead of the courts… The industry, of course, warns that these rules will raise costs for all customers. Such alarms would be more believable if banks were not already jacking up all sorts of fees and charges, and racking up sky-high profits.”

Rule Change Offers Needed Payday Relief ׀ The San Antonio Express-News

“Fortunately, relief is in the works for future payday borrowers who would rather go before a judge… [The CFPB’s] regulation would restrict the use of arbitration clauses in consumer financial contracts that are used to block class-action lawsuits. Requiring those in dire financial straits to shell out $1,000 for an arbitrator to settle a dispute in a case with a net worth of only a few hundred dollars — and prohibiting them from joining those in similar circumstance — leaves few options.”

Free From Fine Print ׀ The Akron Beacon Journal

“The firms have all but blocked the path to class-action lawsuits. That is a moneymaker for them. Route consumers into arbitration, and they essentially are on their own, each to fend against a powerful financial house. No surprise that few consumers take up the expensive fight… [C]onsumers lack tools to check corporate excesses. Arbitration clauses typically have carried provisions barring consumers from even talking about their claims. That factor of secrecy reinforces how the option of a class-action lawsuit becomes necessary to deter deceitful practices and ensure accountability.”

Selected News Clips

When Banks Play Unfairly, Consumers Want Chance to Be Heard in Court | The Los Angeles Times

“The vast majority of consumers want to know they can seek their day in court if they get in a beef with a bank. That’s the main takeaway of a report last week from the Pew Charitable Trusts, which examined so-called mandatory arbitration clauses in bank contracts. These are the provisions that say you can’t sue or join a class-action lawsuit, and if you want to settle a dispute, you have to take it to a professional arbitrator selected and paid for by the bank.”

CFPB’s Arbitration Proposal Draws 13,000 Comments | The Wall Street Journal

“Consumer groups gave the proposal strong backing. More than 280 had worked jointly to build support for the CFPB, mounting a Twitter campaign using the hashtag #RipoffClause to criticize industry efforts to use arbitration clauses and keep cases out of the courts. As of Tuesday afternoon, 12,744 comments received by the CFPB were posted on the federal government’s rules site, regulations.gov, and the number is expected to grow. An agency spokesman said comments received late Monday will be added later, as well as those that were submitted by mail.”

Poll: 70% Of Consumers Oppose Forced Arbitration By Lenders | Financial Advisor

“Seventy percent of consumers from both political parties oppose forced arbitration in loan contracts, the Americans for Financial Reform and the Center for Responsible Lending reported in a poll Wednesday. The right of consumers to go to court against banks and other lenders in class action suits, however, was supported by a greater majority of Democrats (78 percent) than Republicans (63 percent). The survey was done of 1,000 likely 2016 voters between June 16 and 22.”

Arbitration Everywhere, Stacking the Deck of Justice | The New York Times

“Some state judges have called the class-action bans a ‘get out of jail free’ card, because it is nearly impossible for one individual to take on a corporation with vast resources… By banning class actions, companies have essentially disabled consumer challenges to practices like predatory lending, wage theft and discrimination, court records show.”